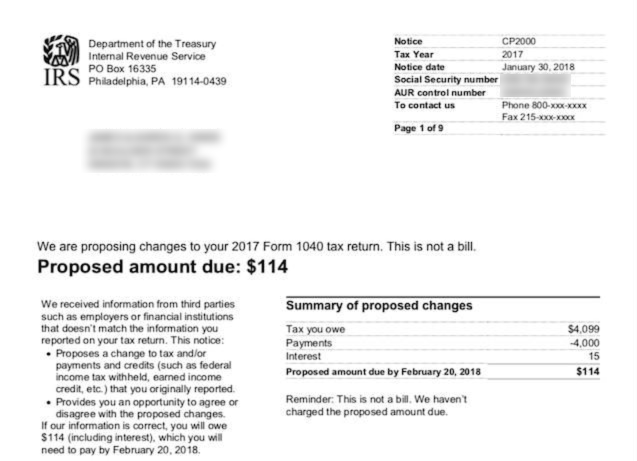

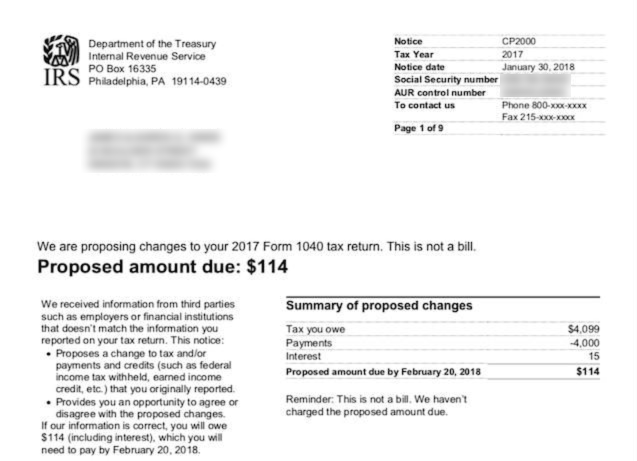

The most recent IRS letter being sent out to cryptocurrency users, the CP2000 notice, is much more specific and informs the recipient of their proposed tax due.

This is an automatic notice that is sent out by the IRS when there are perceived discrepancies between what the taxpayer filed/paid and information acquired from relevant 3rd parties. In the case of cryptocurrency users, the information is provided from a 1099-K, and the relevant 3rd party is likely Coinbase.

1099-K forms paint an often inflated, one-dimensional picture for the IRS. The form includes the total gross proceeds for every transaction on the exchange. This means that if your client sold 1 BTC for $10,000, the IRS would see a gross proceed of $10,000 - even if the client paid $12,000 for the 1 BTC originally, resulting in a $2,000 capital loss.

Recipients should be aware that while the CP2000 notice is not itself a bill, they must take action.